OUR WEALTH INTELLIGENCE SIMPLIFIES YOUR REAL ESTATE EXPERIENCE

“How do I find the right home for our lifestyle and financial goals? How much will it cost? What is the right price? Will something better come along?”

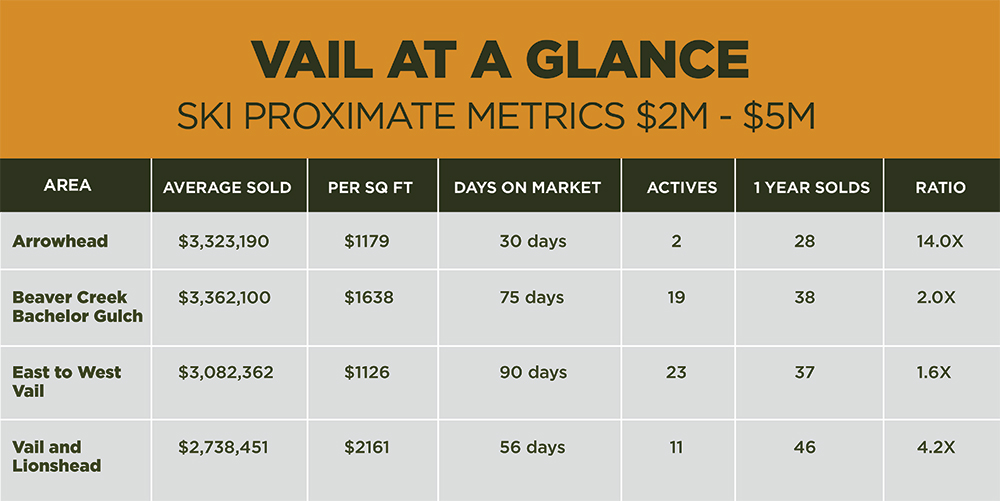

As Eagle County’s only buyer brokerage company for more than 30 years we are dedicated client fiduciaries committed to your best interests with no hidden agendas or undisclosed conflicts of interest. Our company is driven by data analytics, financial analyses, and community connections, based upon one billion dollars of completed transactions over 45 year-long industry careers. World Class Resort real estate is an idiosyncratic asset class that does not correlate with national trends making for a difficult and hard to understand playing field.

Please schedule a time to share your aspirations, questions and concerns in this matter which can take several hours to explain. We promise unbiased Proof of Concept answers which is the first step in a very arduous process. Over the past three decades hundreds of clients have told us they had more fun and made more money in the Vail Valley than ever expected. Let us help you find a property that will unlock a lifetime of discovery while making financial sense as both a long-term investment and family legacy experience.