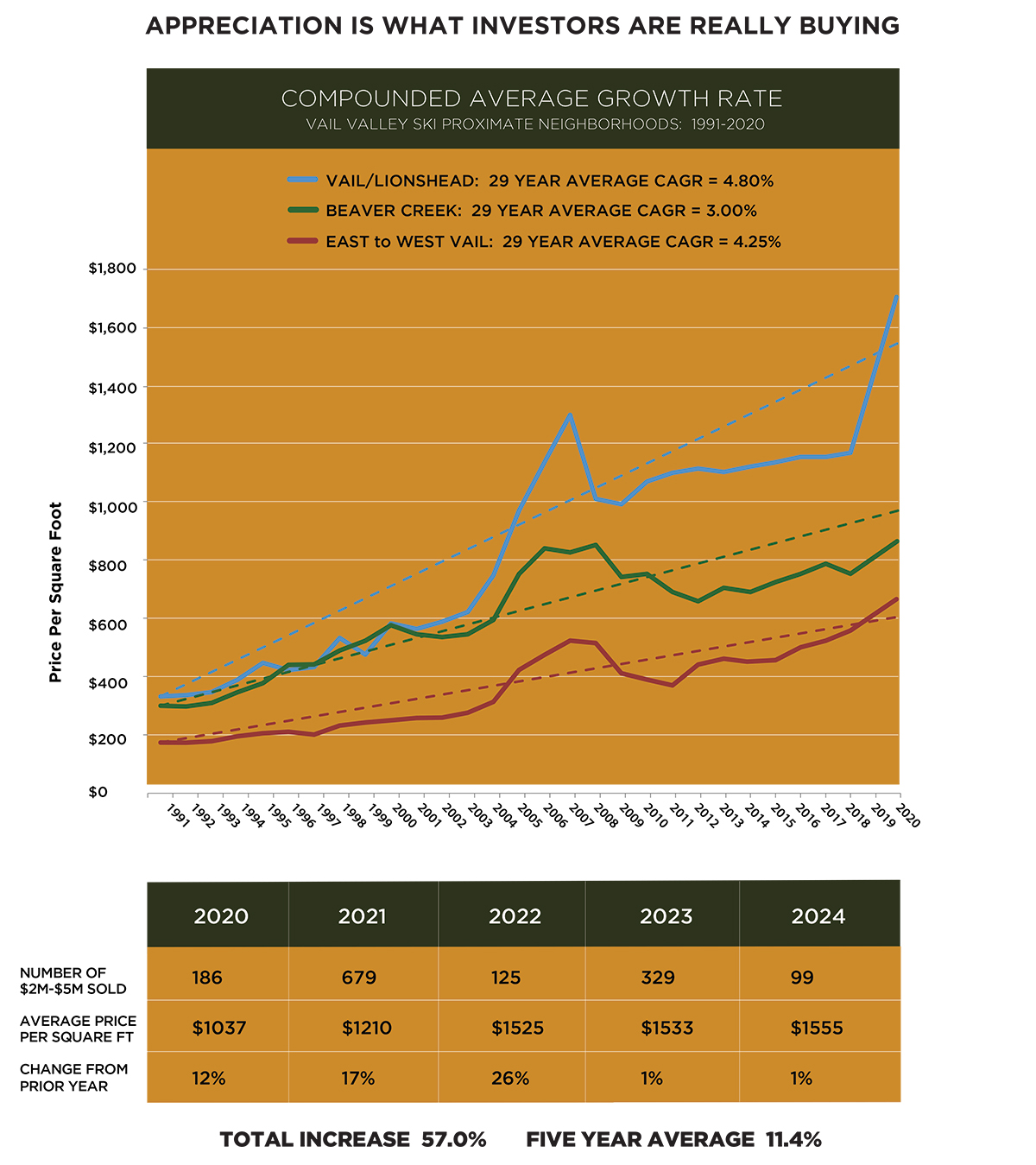

INVESTMENT CHARACTERISTICS:

In the coming years Eagle County’s ski-proximate neighborhoods are poised for continuing success as defined by lifestyle enhancement and financial performance. The asset class should not be confused with the ups and downs associated with US residential home real estate. Although one might argue that the two sectors appear similar, they are each driven by completely different dynamics. To more clearly understand these distinctions, we offer the following commentary which focuses on the demand elements for world class resort property, which by definition are rare and extremely limited in terms of worldwide supply.

Population Demographics: 78 million baby boomers are demanding more travel, leisure, recreation, and vacation home ownership in their never-ending search for lifestyle enhancement and extended family-oriented activities. In a survey of 25,000 households with incomes in excess of $200,000, American Demographics magazine listed a vacation home as the number one desired asset for the nation’s most affluent households as wealth continues to concentrate with these top 10% families driving demand for best-of-the-best resort living.

Socio Economic Profile: A study by the National Association of REALTORS® concluded that the most expensive neighborhoods in the US outpaced national average pricing by 2:1 due to concentration of wealth and demand for best of best locations. Top 10% households will always seek out sophisticated, diverse communities that can satisfy their recreational passions and quality-of-life criteria in safe, affluent and safe harbor for capital locations.

A Vail Renaissance: The worldwide ski industry, which really began in the 1960s, has crossed the 65-year-old threshold, and like any of us in later life suffers from tired infrastructures and deteriorating physical improvements. The best and most desirable locations often have the oldest and most obsolete structures which is out of sync with a discriminating clientele who value new, attractive, well-designed properties not typically found within our industry.

In terms of modernizing and redeveloping base core villages, Vail is leading the way with more than $2.5 billion ($2,500,000,000) in market improvements which is unprecedented within the industry. These capital investments have significant value-added implications and represent a staggering amount of property creation and overall community improvements which are unlikely to be replicated by any other competitor within the industry.

Vail Resorts: The operator of Vail, Breckenridge, Beaver Creek, Keystone, Park City, The Canyons, and Heavenly Valley, Vail Resorts is the recognized industry leader in both mountain operations and resort real estate development. Given the mature and consolidating nature of the industry, Vail Resorts’ long-running strategy of gaining market share through massive capital expenditures on resort products, goods, and services is a proven success formula that will continue in the years ahead.

It is important to recognize that the economic engine driving most ski towns is ultimately the mountain in combination with the successes or failures of the operating company. If the skico is vibrant, responsive and delivers a high-quality and reliable experience, demand increases, and the community at large prospers. However, if the operator hurts demand (as evidenced by the American Ski Company laying off 1,100 employees at Steamboat Springs more a decade ago) towns suffer and property values fall. Because Vail Resorts is a financially robust, public, and a forward-thinking company, we anticipate continued success in this competitive industry, with Vail Resorts’ dominating the worldwide destination ski and mountain lifestyle experience.