THE LISTING PROCESS

Our mission is to sell your property for the most money possible, in the shortest amount of time, with the least number of problems and hassles. Underpricing brings you less money; over pricing deters serious interest. It’s a balancing act that requires experience, comparable sold data, and an understanding of the supply vs. demand imbalances. Vail Property Brokerage understands what buyers want, their decision-making process, how to have your property stand out, and a one-of-a-kind marketing approach that will get the job done.

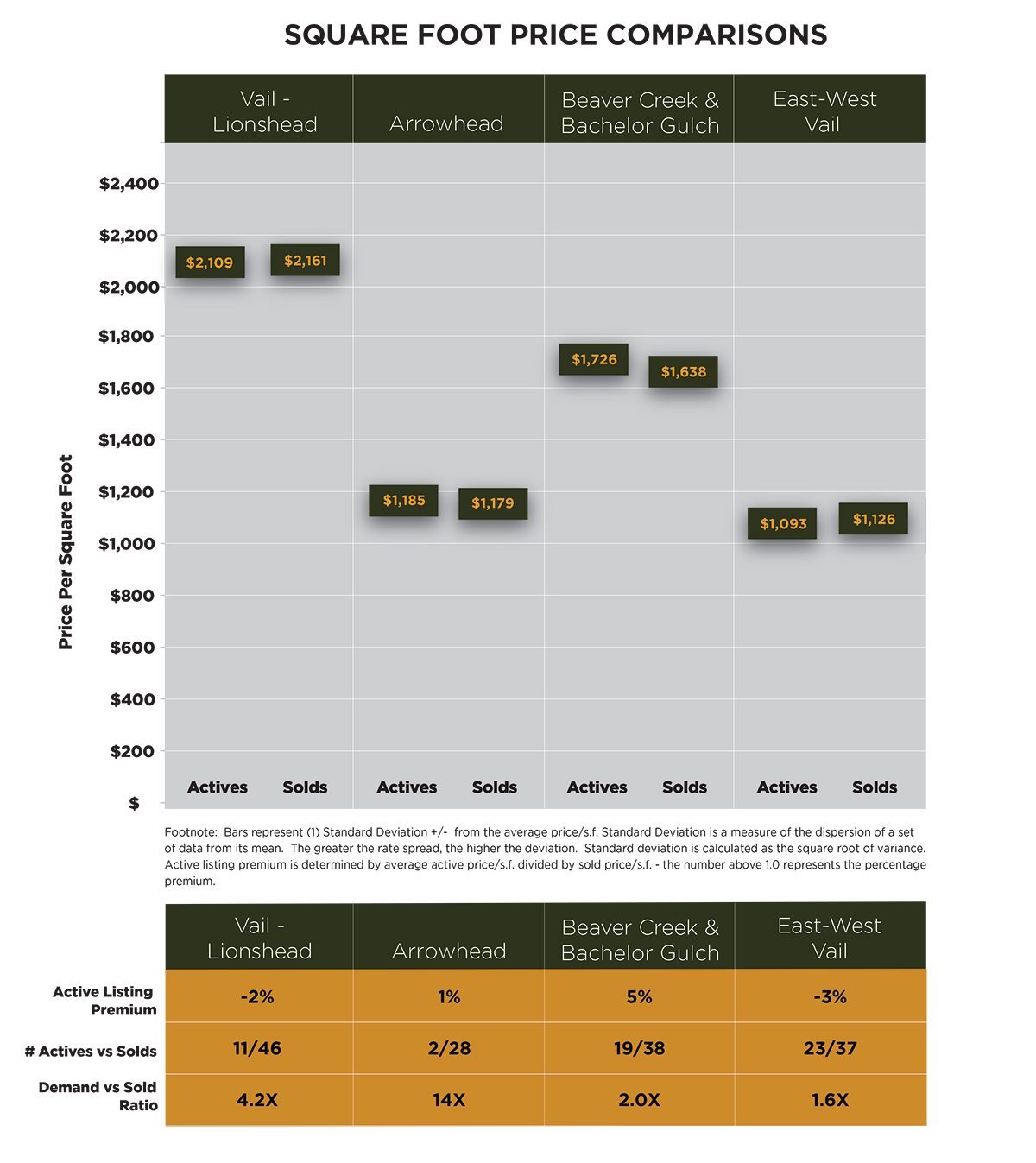

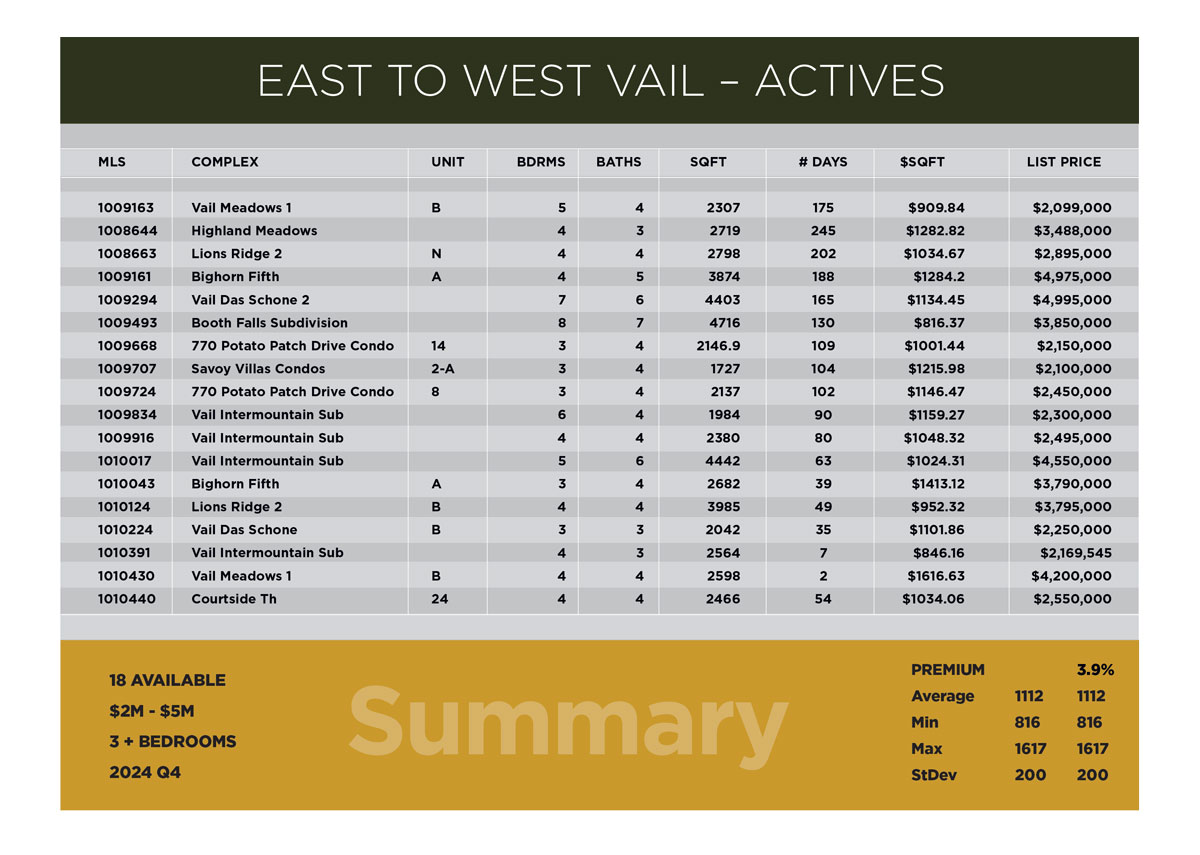

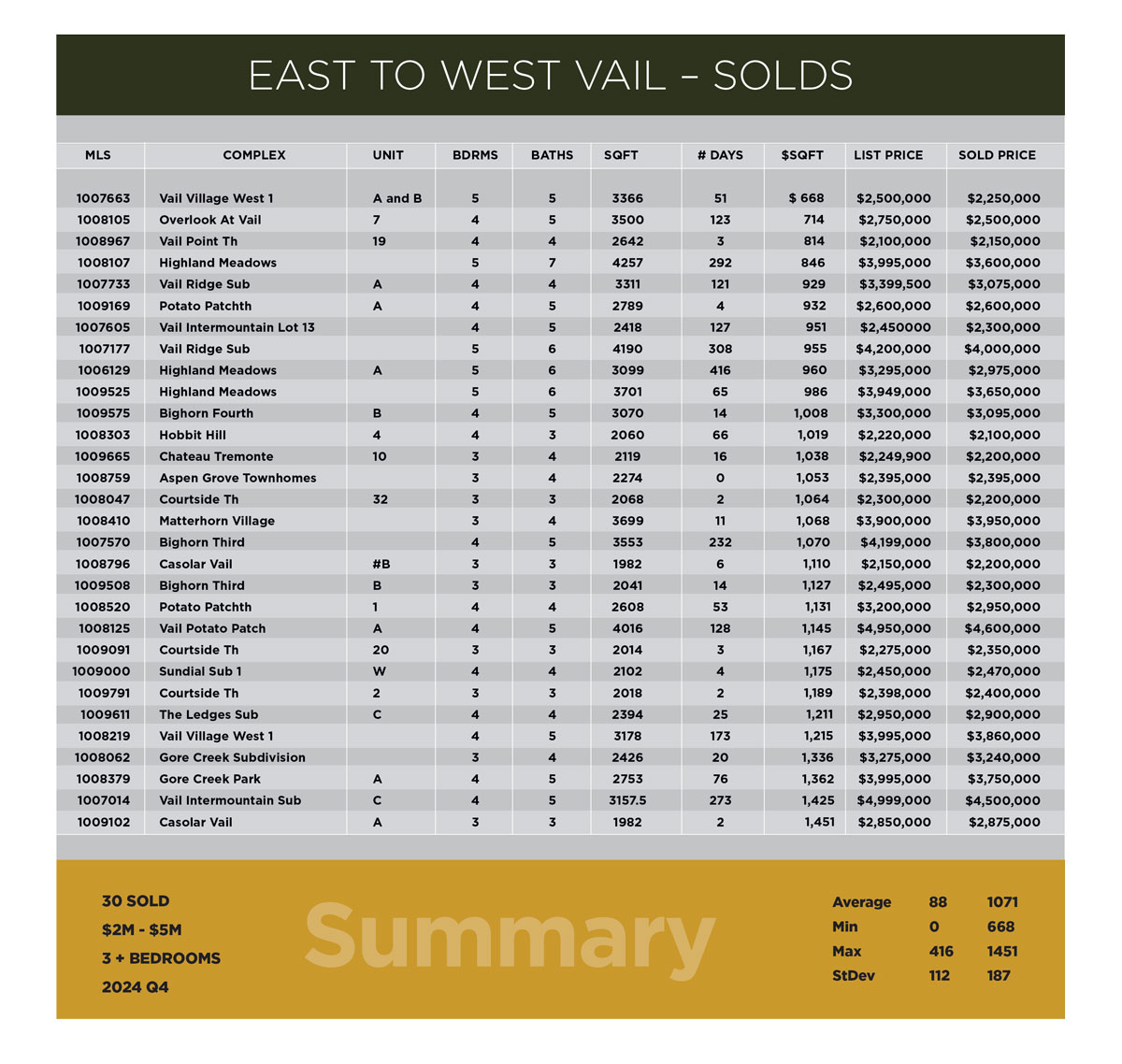

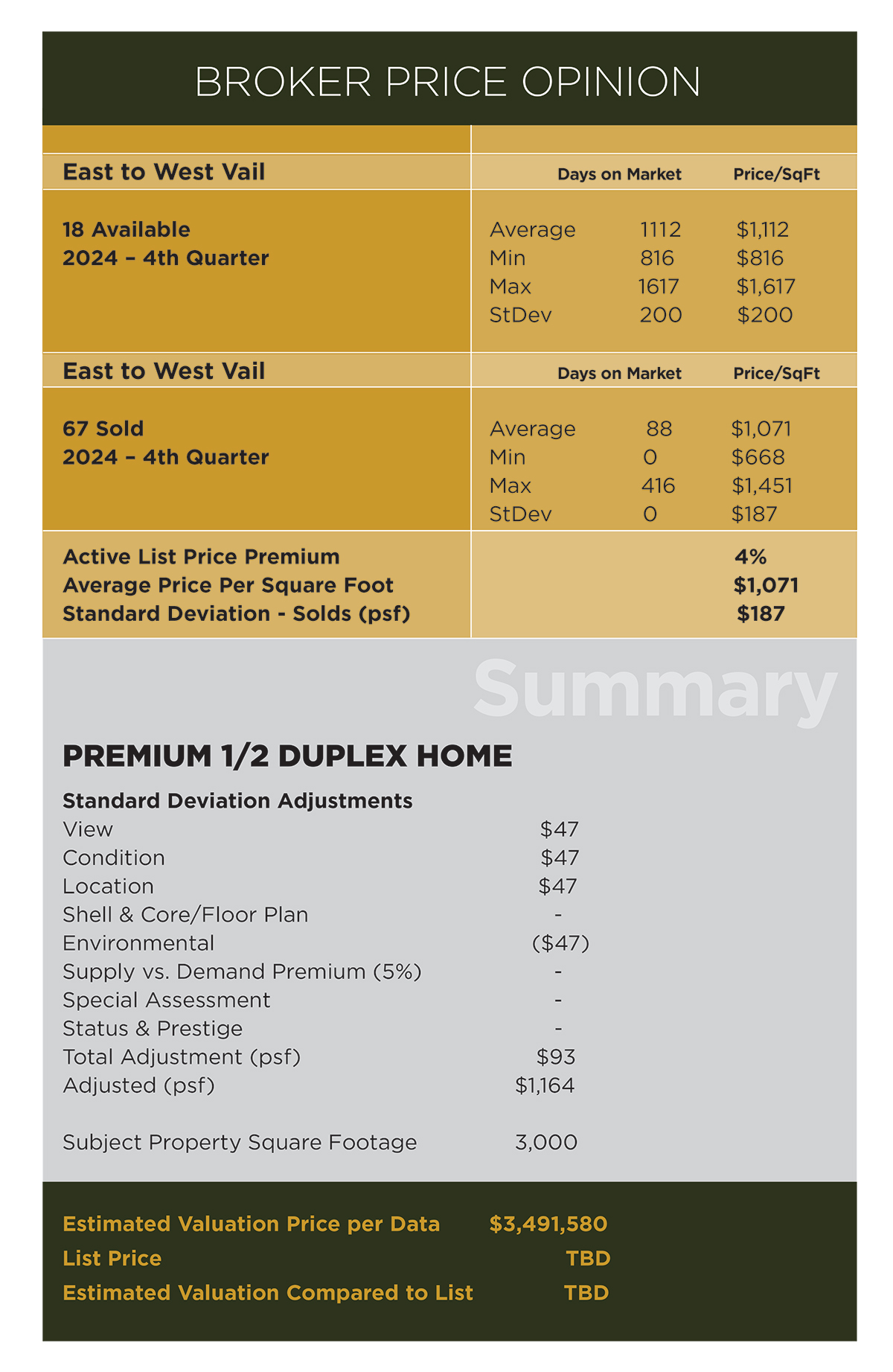

Please click on the below tabs to see the comparative market data

Vail Property Brokerage is the Central Rockies only vacation home investment advisory company focusing on our client’s commitment of time and money which for most people are two of their most valuable resources. Our fiduciary responsibilities include teaching clients how to go about making a smart real estate deal while fostering a credible working partnership between the parties.

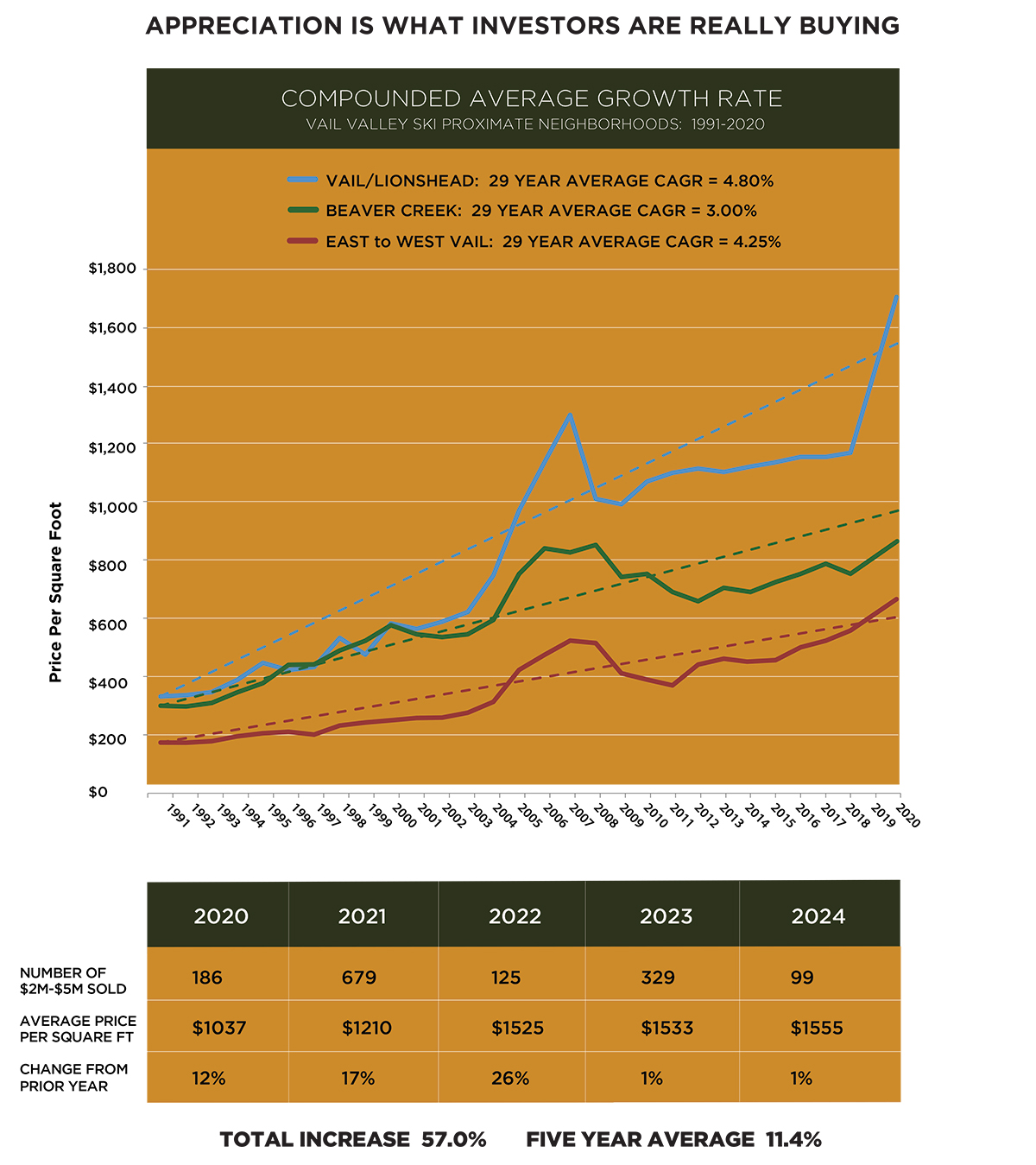

World class resort real estate has always been a capital appreciation investment asset class. The upside is dictated not so much by what you buy or how much is paid, but rather the successes or failures of Vail & Beaver Creek as playgrounds for the rich and not so famous.

The appreciation drivers are multi-faceted so think of these elements as a three legged stool.

1. Population demographics. One quarter of the US and most other WWII conflict nations have a baby boomer demographic who is now approaching retirement and/or the promise of more time away from the office. The Great Recession postponed Boomer retirement by about 10 years with this cohort now 56-74 in age. These Baby Boomers are going to change America as they begin to work remotely while living in higher quality of life places. This demand profile is going to change world class resort resort real estate in many ways including increasing prices with magnitude and timing impossible to predict.

2. Affluency of customer base. The top 10% of US households own 88% of all the investible assets according to the Wall St Journal. Concentration of wealth will continue to erode the middle class widening an already considerable inequality gap. The New York Times projects that Top 10% US households will earn 90% of all future increases to income which means the rich will get richer which is unfortunate but true nevertheless. The key is to find asset classes that are of interest to these moneyed families which have always been Vail’s traditional customer base. There may be other places with this affluency profile but there aren’t any better. International visitation to Vail has tripled over the past 5 years as multi-nationals seek safe harbors for accumulated wealth. We expect this trend to accelerate in the years as evidenced by Mexican and South American Latinos coming in increasing numbers based upon capital preservation and family security concerns.

3. Ski company. If you want to know how a ski town is going to do; study the ski company. If they create more demand for their products, goods, and services in the context of a fixed supply market we all win. Vail Resorts is the best managed, most experienced, a Fortune 500 company and is arguably the most successful ski operating company in the world. Their success formula is based upon massive investments in infrastructure, urbanized amenities, a sense of community and the creation of a lifestyle where lift tickets are now just one a many other activities. After an almost three billion dollar private/public investment spree which started 2004, Vail has reinvented itself as the company’s crown jewel as proven by an international reputation which is only going to grow in the years ahead.

The Vail Valley's long term rate of appreciation will continue along with short term rental income offsets for those families interested in reducing the overall cost of ownership given limited use. Prices surged 20%-25% during the summer of 2017 but have since flattened. Sellers reached for even more in 2018 but not without buyer resistance. During the summer of 2020, 430 families purchased 1.2 billion dollars of ski proximate real estate, at an average selling price of $2.7M. This unexpected early adopter movement may have been ignited by the pandemic but it is the mainstream acceptance of remote working that is the more important story. The FED driven interest rates, the US Treasury's printing of 4 trillion dollars, record setting stock market indices, with inflation looming it only makes sense to diversify the portfolio while celebrating a life well lived with family and friends. The new paradigm shift of how people work and where they will live is expected to be a 3-5 year trend forcing increased pricing as affluent families purchase lifestyle homes in highly desirable places. No one knows what the future will bring but when the capital markets fall which will happen sooner or later, Vail real estate pricing will not suffer but rather there will be intermittent periods of illiquidity which is the most significant downside issue.

Vail Property Brokerage remains dedicated to achieving a dual benefit outcome which means experiences and memories that will last a lifetime in combination with diversified financial performance. This goal and objective is generated via proprietary data driven methodologies that took us decades to develop with hundreds of past client families reporting having had more fun and making more money than they ever expected.